A New Era of Tech, a New Set of Risks and Rewards for High-Income Professionals

If you’re a high-income professional thinking about retirement in the next 5 to 10 years, you’re not just planning for the finish line—you’re navigating a moving target. The AI boom of 2025 is creating one of the most explosive investment cycles in decades. But what does that mean for your financial plan?

At Wurz Financial Services, we help executives, business owners, and professionals in their peak earning years design retirement strategies that are proactive—not reactive. Because when the market shifts, so should your approach.

This Isn’t Just Another Tech Buzzword Moment

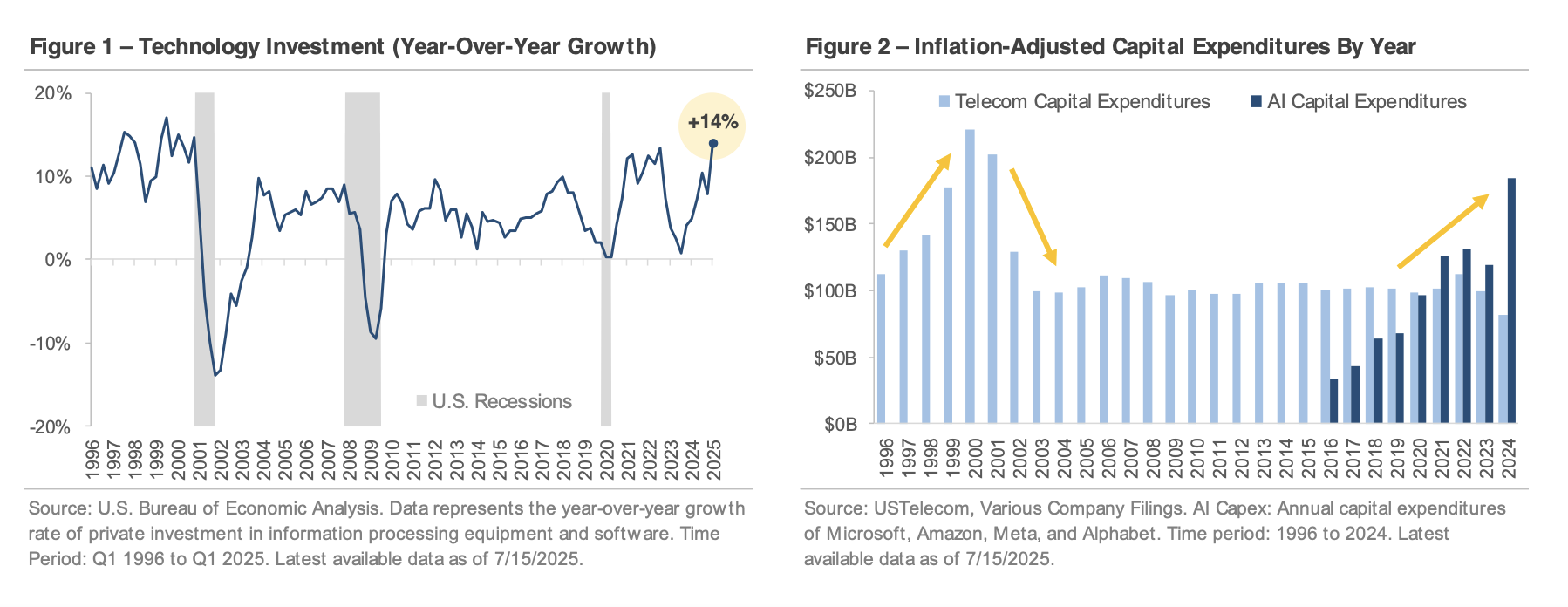

You’ve seen the headlines: artificial intelligence is everywhere. But behind the hype lies a powerful shift in how capital flows through the global economy. In Q1 2025, U.S. companies increased investment in information tech by 14% year-over-year—a pace we haven’t seen since the dot-com era of the late 1990s.

Back then, the world raced to build the digital infrastructure for the internet. Now, companies are pouring billions into training large AI models, constructing energy-hungry data centers, and building out compute power at scale.

This isn’t a bubble—it’s an arms race. And it’s pulling the stock market along with it.

The Market is Booming… But For How Long?

Over the last two years:

- The S&P 500 Technology Sector gained 66%

- The S&P 500 Index grew 42%

- The Magnificent 7 (Nvidia, Meta, Microsoft, Amazon, and others) surged 89%

These aren’t just numbers. If your 401(k), stock portfolio, or executive comp plan is heavily tilted toward tech, you may have ridden this wave higher without realizing it. But here’s the truth: what goes up too fast often comes down just as quickly.

Markets are cyclical. Retirement is permanent. Your financial plan must bridge both realities.

Two Smart Moves for Professionals Planning to Exit in the Next Decade

1. Stop Thinking Like a Speculator. Start Thinking Like a Future Retiree.

Speculators chase trends. Retirees protect income. If your investments aren’t aligned with your future withdrawal strategy, you could be sitting on a portfolio that’s rich in paper gains—and poor in income security. Now is the time to realign for stability, tax efficiency, and sustainability.

2. Use Market Momentum to Your Advantage—Before It Turns

This AI-driven run-up creates a window of opportunity. Are you harvesting gains to build your retirement income base? Rebalancing into diversified buckets? Tax-loss harvesting? These aren’t just tactics—they’re retirement accelerators when used strategically.

Your Career Took Decades. Don’t Leave Retirement Up to Chance.

As a high-earning professional, you’re likely juggling:

- Deferred comp, RSUs, or stock options

- High tax exposure in retirement

- Complex 401(k), IRA, and brokerage accounts

- Business equity or practice sale considerations

We help you cut through the complexity and design a retirement plan that reflects your real life—not some generic rule of thumb.

At Wurz Financial Services, we’re fee-only fiduciary planners who specialize in working with clients like you. No product pushing. No commission conflicts. Just honest, intelligent advice.

📅 Book Your Retirement Strategy Call

Let’s make sure your money is ready when you are.

Disclosures

The content above is for informational purposes only and should not be considered personalized financial advice. Investing involves risks, including loss of principal. Index performance is not indicative of future results and cannot be directly invested in.