AI and Iran Rattle Markets – Why Diversification Matters More Than Ever

Markets are unsettled right now. Here’s what’s driving it, what the February data showed us, and why your portfolio is built for exactly this kind of moment.

If you’ve been watching the news, you know it’s been a turbulent few days. On February 28th, the United States and Israel launched coordinated military strikes on Iran in an operation aimed at dismantling its nuclear program and military infrastructure — a major escalation that is still unfolding as we write this. Markets are reacting, and alarming headlines are everywhere. We want to give you some context, some calm, and a clear-eyed look at what this means for your financial plan.

But first, let’s look at what February’s market data already told us — because it contains an important lesson that applies directly to what’s happening right now.

| 📊 FEBRUARY AT A GLANCE • S&P 500 (overall index): -0.8% • Average stock (equal-weighted index): +3.5% • Large value stocks: +2.6% • Small cap stocks (Russell 2000): +0.8% • U.S. Bonds: +1.6% • International developed markets: +4.6% • Emerging markets: +5.5% • Gold: +10% |

February’s Hidden Story: Most Stocks Rose

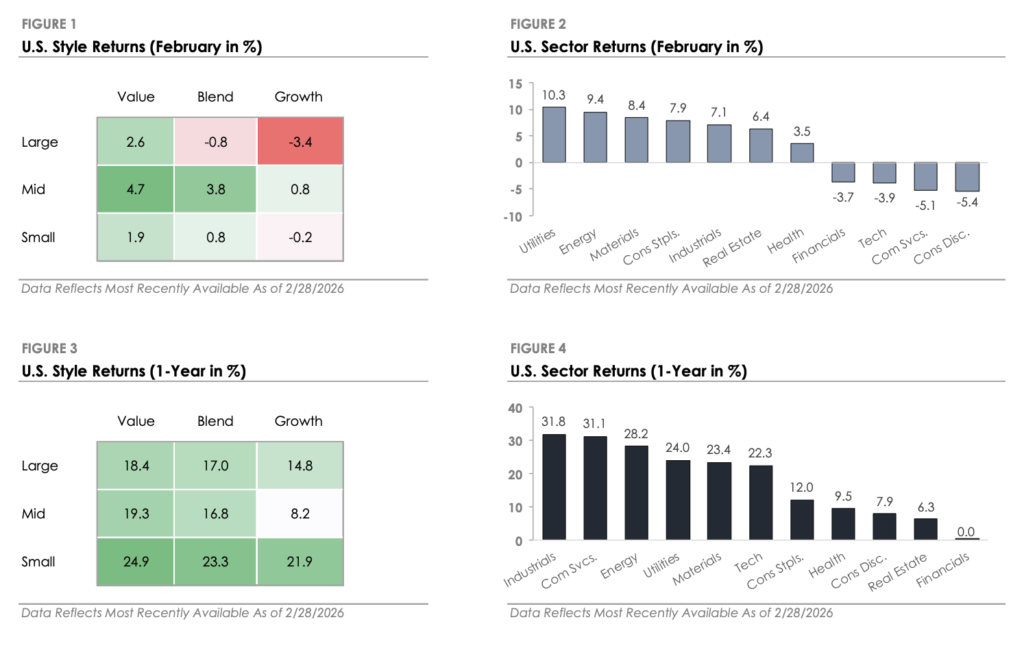

Here’s something the headline number missed. The S&P 500 fell 0.8% in February — but the average stock actually gained over 3.5%. How is that possible? A small number of very large technology companies carry an outsized weight in the S&P 500. When those few stocks fall, they can drag the whole index down even when hundreds of other companies are doing well.

That’s exactly what happened. Technology stocks sold off sharply as investors grew nervous that artificial intelligence — advancing faster than anyone expected — could disrupt entire industries: software companies, consulting firms, real estate services, freight brokers, and more. The fear drove heavy selling early in the month.

Meanwhile, energy stocks surged 9.4%, utilities climbed 10.3%, and consumer staples rose 7.9%. Seven of eleven major market sectors beat the S&P 500. The equal-weighted index — which treats every company the same regardless of size — gained 3.5%. Investors with diversified portfolios spread across sectors had a much better February than the headline suggested. That’s not coincidence. That’s diversification doing exactly what it’s supposed to do.

What’s Happening in Iran — and What It Means for Markets

On February 28th, the U.S. and Israel launched coordinated strikes on Iran targeting its nuclear facilities, missile sites, and military leadership. Iran’s Supreme Leader Ali Khamenei was killed in the initial strikes. Iran has since retaliated with drone and missile attacks across the Middle East, striking U.S. military bases in Bahrain, Saudi Arabia, Kuwait, and the UAE, as well as civilian infrastructure in Gulf cities. The conflict is ongoing and fluid.

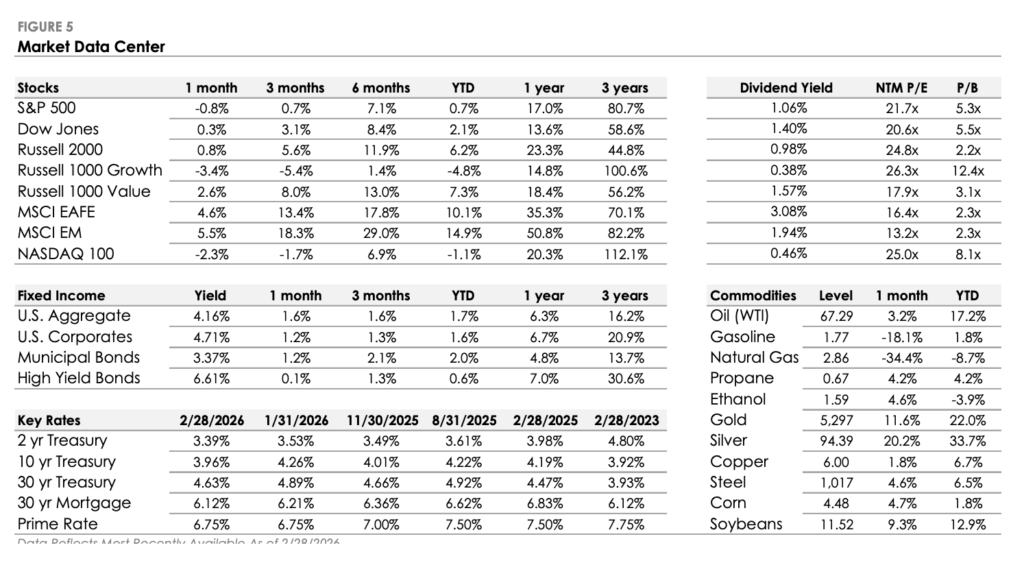

Markets have reacted predictably to this kind of sudden geopolitical shock. The Dow Jones dropped more than 1,000 points in early March trading. Oil shipping rates have surged as Iran has threatened to close the Strait of Hormuz — the critical waterway through which roughly 20% of the world’s oil supply passes. Gold, which rose 10% in February as tensions were building, may climb further as investors seek safety.

This is unsettling to watch. But history offers important perspective: markets have faced geopolitical crises before — wars, terrorist attacks, energy shocks — and have recovered. The investors who fared worst in those moments were the ones who made reactive decisions at the height of the fear. The ones who fared best were those with diversified portfolios and the discipline to stay the course.

Why Diversification Is Your Best Defense Right Now

The Iran conflict illustrates exactly why we don’t build portfolios concentrated in single sectors, geography, or asset class. When geopolitical risk spikes, some assets fall while others rise. Bonds typically gain as investors seek safety. Gold tends to appreciate. Energy stocks can benefit from rising oil prices. International exposure may behave differently than U.S. stocks.

February showed this in real time. Bonds returned 1.6% as Treasury yields fell below 4% — the lowest since October — reflecting investor demand for stability. Gold surged 10%. International stocks outperformed U.S. stocks for the third straight month. The parts of a diversified portfolio that weren’t in tech helped cushion the blow.

That pattern is likely to continue as the Iran situation develops. A well-diversified portfolio is designed to weather exactly this kind of uncertainty — not by predicting what happens next, but by ensuring that no single event can inflict catastrophic damage.

The Economic Backdrop Remains Solid

Amid the noise, it’s worth anchoring to what the underlying economy looks like. The Federal Reserve held interest rates steady at its January meeting, and inflation continues to cool — core CPI is now at a 2.5% annual rate, the lowest since 2021. The labor market added 130,000 jobs in January, unemployment ticked down to 4.3%, and manufacturing activity expanded for the first time in nearly a year.

The Fed is in no rush to cut rates. Markets expect two cuts this year, starting no earlier than June. This is a sign of confidence, not complacency — the economy doesn’t need emergency intervention. Steady growth and cooling inflation give us a sturdy foundation, even as geopolitical events create turbulence on the surface.

What This Means for Your Portfolio

Moments like this one — when markets are turbulent and the news is frightening — are precisely when having a long-term plan and a trusted advisor matters most. It’s easy to stay the course when markets are calm. The real test is now.

The February data already showed us that diversified portfolios can hold up well even when the headline number is negative. The Iran conflict adds a new layer of uncertainty, but it doesn’t change the fundamentals of sound financial planning. Your portfolio isn’t built for a world without risk. It’s built for this world — the one that actually exists.

Markets will remain volatile as the situation in Iran develops. We’re watching closely, rebalancing and making adjustments as needed, and will keep you informed. If you’d like to talk through what this means for your specific situation, don’t hesitate to reach out. That’s exactly what we’re here for.

Important Disclosures

This commentary is provided for informational and educational purposes only and should not be considered personalized investment, tax, or legal advice. The views expressed are based on current market conditions and are subject to change without notice.

Any forward-looking statements reflect expectations as of the date of this publication and involve risks and uncertainties. Actual results may differ materially due to changes in market conditions, economic factors, interest rates, inflation, government policy, or other unforeseen events.

Past performance is not indicative of future results. Market returns can vary significantly from year to year, and investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in all market environments.

References to specific asset classes, sectors, or investment themes are for illustrative purposes only and do not constitute a recommendation to buy or sell any security. Diversification does not ensure a profit or protect against losses during market declines.

Interest rate changes, inflation trends, and economic conditions can affect both equity and fixed-income investments. Bond values may fluctuate as interest rates change, and corporate bonds carry credit risk related to the financial health of the issuing company.

This material should not be relied upon as a sole basis for making investment decisions. Investors should consider their individual goals, risk tolerance, and financial circumstances and consult with their financial advisor before making any investment decisions.