By nature, we have a tendency toward comparison. When we feel we’re doing better than our neighbors, literal or figurative, we pat ourselves on the back. On the other hand, when there’s a part of our lives where we are not quite up to par, we quickly believe the grass is greener in someone else’s yard. But truth be told, this tendency isn’t always a bad thing. Comparing apples to apples can provide you with a baseline to gauge whether or not you are on track with things such as your retirement plan. And while having a baseline is great, when it comes to more complex topics, like your finances, how do you make sense of all the information available in light of your own unique situation?

With the internet, you don’t have to look far to find more retirement information than you’ll ever need. There is plenty of advice on when to start saving, what the best strategies are, and what amount of money will get you through your golden years.

Unfortunately, much of this generic advice can be contradictory or overwhelming because everyone has their own set of unique desires and obstacles. We are told that we need X amount for a 20-year retirement, or that we should contribute X amount to our 401(k). The experts tell us to pay off all our debt but make sure we have enough liquidity for emergencies. These are great suggestions, and there’s plenty of helpful information available, but how do you make sense of it based on your own personal situation? Since retirement is one of the biggest financial milestones you’ll reach in life, don’t you want to really know if you’re on track? Don’t you want to be more than just hopeful that you will be financially ready?

Comparing The Numbers

With Baby Boomers retiring every day, the Census Bureau predicts that the population aged 65 and over will grow 50% between 2015 and 2030. Because of this, the U.S. Government Accountability Office was tasked with finding out how well prepared American workers are for retirement. They published a comprehensive report in 2015 (1) that we can use to see if your retirement savings are on par with others your age.

Whether you think you’re on top of things or way behind, you may be surprised by where you actually stand compared to what statistics show about retirement savings. Let these numbers serve you like a pat on the back or a kick in the pants.

If You’re Between The Ages Of 55 And 64

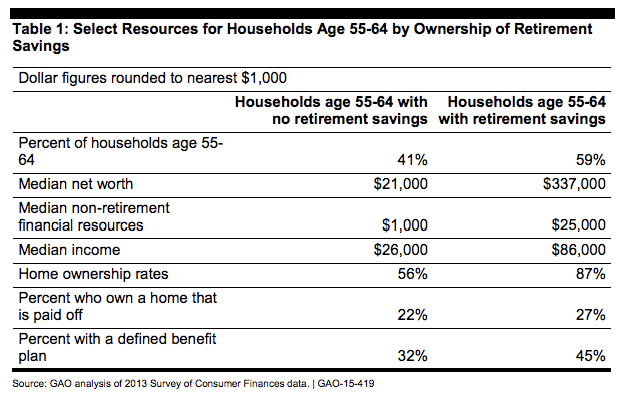

It may surprise you, but if you have at least $1 saved for retirement, you’re doing better than 41% of those surveyed, and if you have at least $25,000 saved, you’re in the top 59%. Though those numbers may make you feel good about yourself, they don’t guarantee you a comfortable retirement. While you may not know how much you need for retirement, we can be sure it’s more than $25,000.

Here is a table from the GAO’s report showing how resources are divided between households with and without retirement savings in this age group.

Not shockingly, those without retirement savings don’t have a lot to fall back on. Since they lack additional resources, they will be very dependent upon pension plans and Social Security to carry them through their retirement years. And of the 59% that have saved, the median nest egg is only about $104,000. That may sound like a lot, but the unfortunate truth is that that probably won’t be enough to live worry-free throughout your golden years when we consider increasing longevity and healthcare costs.

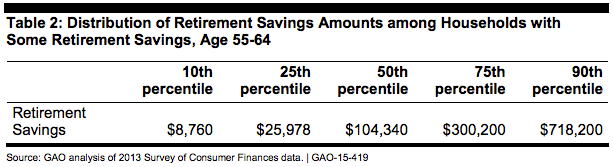

In Table 2, you can see how much savers have actually managed to put away. Where do you fit in?

In this age group, it seems that only the very top savers are ready for retirement. Most of them are still working, though. What about those a decade older? How do you compare to those who have already reached retirement?

If You’re Between The Ages Of 65 And 74

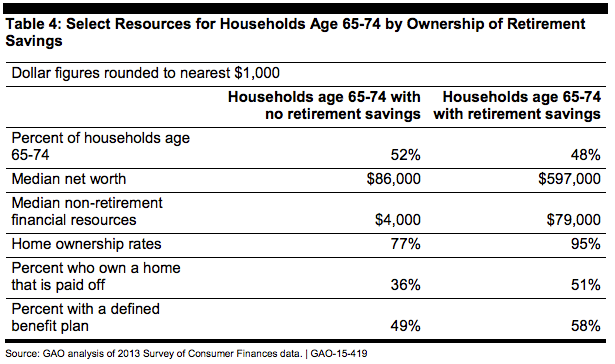

65 is still a popular retirement age, though more and more people are extending this date so they can catch up with their retirement savings. Similar to the previous age group, this bracket doesn’t have much in savings. Here is a chart showing the exact same information as the previous age bracket:

In this age group, people are a little more prepared but with only a slightly larger nest egg. However, the median net worth has increased and homeownership rates are higher. Let’s look at their savings breakdown:

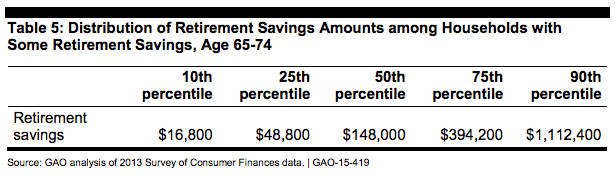

Surprisingly, the median amount saved is not significantly higher than that among households aged 55-64. It only increases from $104,000 to $148,000. The lower percentiles nearly double their savings. Where do you fall? If you’re in the 90th percentile, you are probably okay (assuming modest spending). But what about the lower percentiles?

It doesn’t take a whole lot of savings to look good relative to your peers. But how are your savings relative to your current lifestyle? Will you have enough to live the life you want or do you need to double down and save more?

Your Personal Retirement Goals

No matter how you compare to your peers, the fact of the matter is that you won’t be living the same retirement as them. Therefore, you need to figure out how your savings compares to the cost of the retirement you desire. There are a plethora of online retirement calculators, but they are often very generic and fail to take into account the various vital factors that will impact your unique personal situation.

The only way to truly have a clear idea of what you’ll need to retire comfortably is to have a financial advisor run a thorough analysis. A professional can utilize their expertise as well as modern technology to more accurately show you different possible retirement outcomes and how to prepare for both the good and the bad.

How We Can Help

It is a common misconception that if you don’t have much saved, then you don’t have enough to work with an advisor. The truth is, you can’t afford not to work with an advisor, especially if your savings are suffering. Building wealth is an indispensable aspect of retiring well, and partnering with an experienced professional is the best way to do that.

At Wurz Financial Services, we make it our goal to provide you with a solid financial plan that will reduce stress and give you confidence. We want to help you pursue a life of less worry and lack, and more time and resources to devote to your passions. Don’t keep yourself up at night wondering if you will have enough money to retire; come in and get the peace of mind that comes with the security of a solid plan. Contact us at 1-888-510-2362 or dpw@fortunefinancialservices.com today! Also, join us at our next free webinar: How Much Do I Need to Retire? Register here today!

About Darren

Darren Wurz is a co-owner and financial planner at Wurz Financial Services, an independent, family-owned and operated financial services firm dedicated to helping its clients transition from their working life to a comfortable retirement with confidence. Darren received his master’s of science in financial planning from Golden Gate University and also holds the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation. He operates the Northern Kentucky/Cincinnati office of Wurz Financial Services and is an active member of the Covington, KY rotary club, the Northern Kentucky Chamber of Commerce, and the Covington Business Council. To learn more about Darren, connect with him on LinkedIn.

__________